40 are treasury bills zero coupon bonds

Treasury Bond Quotes | US Treasury Bond Rates | FinancialContent ... Via AccessWire. Topics Economy. Exposures Economy Interest Rates. Tickers NAUFF TSX-V:NAU. AEON Credit (00900) 1Q2022 Revenue up by 9.7% to HK$279.1 million. June 23, 2022. Via ACN Newswire. Topics Credit Cards Economy. Exposures Economy Interest Rates. Treasury Bills - Guide to Understanding How T-Bills Work T-bills, T-notes, and T-bonds are fixed-income investments issued by the US Department of the Treasury when the government needs to borrow money. They are all commonly referred to as "Treasuries." T-Bills Treasury bills have a maturity of one year or less, and they do not pay interest before the expiry of the maturity period.

Treasury Bonds | CBK Treasury Bonds Rediscounting Calculator This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. Treasury/ Infrastructure Bonds Pricing Calculator Conventional Bonds and Bonds Re-opened on exact interest payment dates

Are treasury bills zero coupon bonds

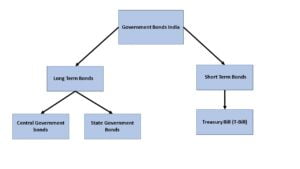

Treasury Bills vs. Bonds: What's the Difference? - Yahoo! Treasury Bills vs. Treasury Bonds. Like their name suggests, Treasury bills and Treasury bonds are debt instruments issued by the U.S. Department of the Treasury to help fund the operations of the ... Government Bonds - Meaning, Types, Advantages & Disadvantages Treasury bills, also known as T-bills, are short term government bonds. They are issued for maturity within one year. The government issues these bonds in three categories, i.e. 91 days, 182 days and 364 days. ... As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue ... Domestic bonds: Greece, Bills 0% 9jun2023, EUR (364D) GR0004128543 Issue Information Domestic bonds Greece, Bills 0% 9jun2023, EUR (364D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Zero-coupon bonds, Bills. ... Treasury bills are instruments of money market with the maturity up to 1 year. Also there are 21 government bonds with the maturity up to 30 years. The level of Central ...

Are treasury bills zero coupon bonds. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.371% yield. 10 Years vs 2 Years bond spread is 38.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation ... U.S. Treasury Bonds, Bills and Notes: What They Are and How to Buy Investors in longer-term Treasurys (notes, bonds and TIPS) receive a fixed rate of interest, called a coupon, every six months until maturity, upon which they receive the face value of the bond.... Treasury Bills (T-Bills) Definition - Investopedia T-bills are zero-coupon bonds that are usually sold at a discount and the difference between the purchase price and the par amount is your accrued interest. How Can I Buy a Treasury Bill? U.S.... Treasury Inflation-Protected Securities (TIPS) Definition 17/02/2022 · Treasury Inflation Protected Securities - TIPS: Treasury inflation protected securities (TIPS) refer to a treasury security that is indexed to inflation in order to protect investors from the ...

Domestic bonds: USA, Bills 0% 15dec2022, USD (182D) US912796X793 Domestic bonds: USA, Bills 0% 15dec2022, USD (182D) US912796X793 Download Copy to clipboard Zero-coupon bonds, Bills Issue Issuer JCRA - *** Scope - *** Status Outstanding Amount 46,871,036,300 USD Placement *** Early redemption *** (-) ACI on *** Country of risk USA Current coupon *** % Price *** % Yield / Duration - Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds. Treasury Bonds Explanation & Examples - Study.com Bond interest rates started very low in early bonds, with treasury bonds issued in the 1910s and 1920s holding interest rates from 1-3%. Interest rates remained low for several decades until the ...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Nigeria Government Bonds - Yields Curve Last Update: 28 Jun 2022 17:15 GMT+0. The Nigeria 10Y Government Bond has a 11.210% yield. 10 Years vs 2 Years bond spread is 315.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 13.00% (last modification in May 2022). The Nigeria credit rating is B-, according to Standard & Poor's agency. Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 30 Year Treasury (US30Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

Weekly Forecast: Peak In 1-Month Forward Treasury Yields Drops 0.11% In the aftermath of the Fed's rate hike last week, Treasury yields settled in at a lower level, with the peak in 1-month forward rates down 0.11% for the week. The probability of an inverted ...

A guide to US Treasuries Separate Trading of Registered Interest and Principal of Securities (STRIPS): Treasury STRIPS, also known as zero-coupon Treasuries, let investors hold and trade the interest and principal of certain T-notes and bonds as separate securities.

Meaning, Types & Examples of Government Securities in India Bonds issued to the public at a discount on face value but redeemed at par are zero-coupon bonds. These were first issued on January 19, 1994. These bonds have a fixed maturity period. The difference between the discounted rate at face value and the redeemable amount at par acts as the return on investment. Partly Paid Stocks:

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

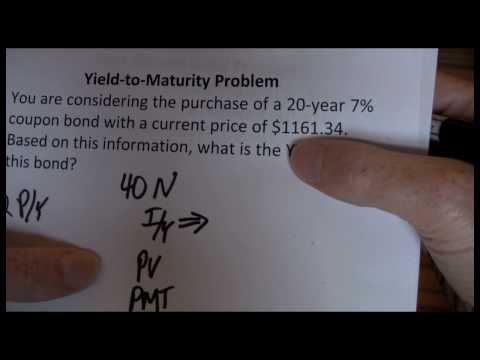

Learner Reviews & Feedback for Global Financial Markets and Instruments ... Finally, you will learn how to value fixed income securities such as Treasury bills, zero-coupon or coupon-bonds and compute yields. Topics covered include: • Explain the roles of financial markets • Distinguish between real and financial assets • Define and explain money market instruments, zero-coupon and coupon- bonds and features ...

EGP T-Bonds Zero Coupon USD T-Bills; EUR T-Bills; Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. ... EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 1.5: Auction date: 18/04/2022: Issue date: 19/04/2022:

SGS Bonds: Information for Individuals Step-by-step guide to investing in SGS bonds. Find information on how to buy, check, and manage your SGS bonds. Understanding SGS Bonds. Get more information on SGS bonds to determine if it is the right investment before buying. Singapore's Bond Market Overview; Buying and Selling SGS Bonds. Find out how to buy SGS bonds at an auction: How to Buy

【How-to】How can i earn treasury bill in the philippines - Howto.org Treasury Bonds are obligations with maturities ranging from 2 years to 25 years, typically issued at par with periodic coupon payments to be made up to final maturity. Some bonds may be issued without coupons and these are known as zero coupon bonds. … Interest rates are paid semi-annually based on a fixed coupon rate.

What Are Treasury STRIPS? - Investment Guide - SmartAsset When stripping of Treasury bonds began, the government discouraged the practice due to concerns about lost tax revenues. However, in 1982 tax laws were modified to change tax treatment of zero-coupon bonds.The Treasury department then accepted stripping and also began issuing bonds electronically, without paper certificates or coupons.

41 are treasury bills zero coupon bonds Treasury Bills - Meaning, Types, Yield Calculation & How to Buy? 10/09/2020 · Treasury bills are zero-coupon bonds, i.e. no interest is paid on them to investors. They are issued at a discount and redeemed at face value.

Zero-Coupon CDs: What They Are And How They Work - Bankrate How do zero-coupon CDs work? You'll pay a discounted price for a zero-coupon CD in exchange for not being paid interest throughout the term. You'll receive the full face value of the CD, plus ...

Domestic bonds: Greece, Bills 0% 9jun2023, EUR (364D) GR0004128543 Issue Information Domestic bonds Greece, Bills 0% 9jun2023, EUR (364D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Zero-coupon bonds, Bills. ... Treasury bills are instruments of money market with the maturity up to 1 year. Also there are 21 government bonds with the maturity up to 30 years. The level of Central ...

Government Bonds - Meaning, Types, Advantages & Disadvantages Treasury bills, also known as T-bills, are short term government bonds. They are issued for maturity within one year. The government issues these bonds in three categories, i.e. 91 days, 182 days and 364 days. ... As the name suggests, Zero coupon bonds have no coupon payments. The profits from these bonds arise from the difference in the issue ...

Treasury Bills vs. Bonds: What's the Difference? - Yahoo! Treasury Bills vs. Treasury Bonds. Like their name suggests, Treasury bills and Treasury bonds are debt instruments issued by the U.S. Department of the Treasury to help fund the operations of the ...

.jpg/220px-1969_%24100K_Treasury_Bill_(front).jpg)

:max_bytes(150000):strip_icc()/GettyImages-1139098478-28612b269b254a2488a4b4743dc4a9b9.jpg)

Post a Comment for "40 are treasury bills zero coupon bonds"